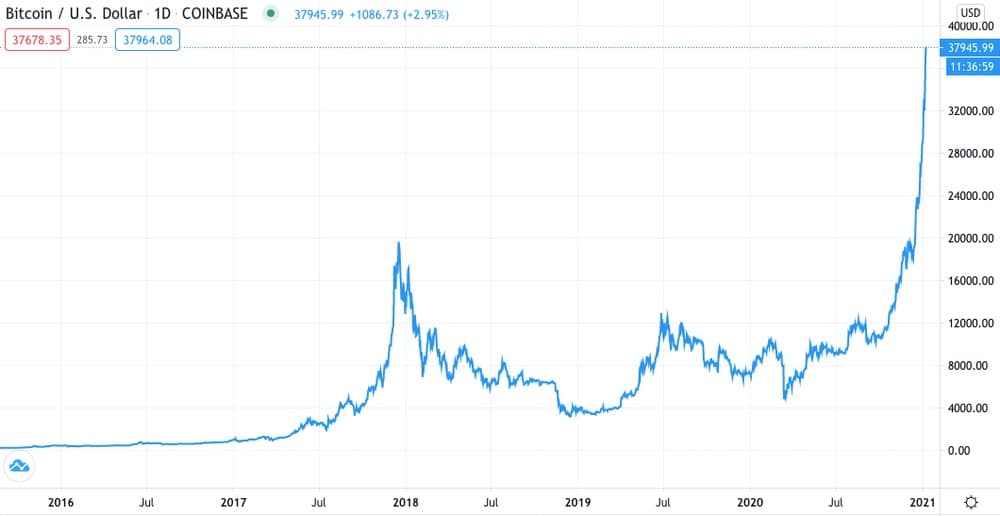

$72,902,650. That is how much you would have made by mid-February 2021 if you had invested $100 in Bitcoin on July 28, 2010, according to calculations by Fortune. That’s a staggering 72,902,550% return on investment, or 259.51% in annualised terms.

However, no one can blame you for failing to foresee the potential of the cryptocurrency. Bitcoin was mostly viewed as a geeky pastime in its early years, more San Francisco Bay than Wall Street. Later on, the cryptocurrency became better known for its stratospheric price rises and precipitous busts—a catnip for hardcore speculators but a put-off for practically everyone else—and associations with crime.

The unprecedented buy-ins

All that seems to have changed if the immediate past is anything to go by. For instance, since November 2020, PayPal has allowed its U.S. account holders to buy, hold, and sell Bitcoin and other cryptocurrencies. In the second week of February 2021, MasterCard announced that it would allow merchants to accept these currencies.

Large financial institutions are showing interest as well; Blackrock, BNY Mellon, and Morgan Stanley, for example, plan to offer a cryptocurrency asset class. Even Elon Musk has gotten into the game! In the first week of February 2021, Tesla announced that it had invested $1.5 billion in Bitcoin and planned to accept payments in the cryptocurrency. On the news, the Bitcoin price surged to nearly $50,000, its highest point ever.

Should you follow Musk’s lead? It is difficult to figure out how Bitcoin will perform as an investment in the coming months and years. Do not let that scare you off, though; with knowledge, patience, and an extra-large helping of caution, it is possible to make money off a Bitcoin investment.

Peering into the Bitcoin price crystalball

The attraction of Bitcoin as an investment rests on the assumption that its price will keep rising in the future. That assumption has not always held true in the past; the price of cryptocurrency has fallen by as much as 80% several times in its existence. However, there are several reasons to think its price may keep rising, at least for the foreseeable future.

Reason one: blossoming interest from wealthy individuals and institutional investors, which we looked at in the previous section. Apart from Musk, other affluent people who have invested in Bitcoin include Christian Armbruester, the founder of Blu Family Office, a London-based investment firm for wealthy clients, and Mexican media billionaire Ricardo Salinas Pliego. Wall Street legends like Stanley Druckenmiller, former chairman and president of Duquesne Capital, and Bill Miller, a former chairman and chief investment officer of Legg Mason Capital Management, have endorsed buying the cryptocurrency.

The growing interest from wealthy individuals and institutional investors has, in turn, encouraged the development of an industry dedicated to helping people successfully navigate the legal and trading risks of Bitcoin so that they can treat it like any other asset. This will likely spur greater Bitcoin demand and a further price rise.

Stock-to-flow, or SF, model predictions also suggest that the price of Bitcoin will keep rising. The SF model is a statistical framework analysts use to predict the future price of commodities such as gold and silver by determining their scarcity. To compute an SF ratio, analysts divide the commodity’s quantity in inventory by the amount produced or mined annually. You can probably see why analysts would use this model to try and predict the future price of Bitcoin. And it works surprisingly well, too, considering just how volatile the cryptocurrency price is.

A high SF ratio indicates that the annual production is a tiny fraction of the total quantity available and is associated with a high per-unit price. In contrast, a low SF ratio shows otherwise. Gold had an SF ratio of 58 at the close of November 2019, one of the highest among all precious metals. After the May 2020 halving, Bitcoin had an SF ratio of 52, suggesting that if supply is further constrained and demand increases, its price could hit highs of $100,000 or more.

Bitcoin’s supply is significantly constrained during halving events, which reduces the reward miners receive per block by 50% and almost always causes price increases. The first halving was in 2012, when the cryptocurrency price was $11. In the days after the halving, the price rose to $12; that had surged to $1100 in a year. The second halving was in 2016, after which the price oscillated between $500 and $1000 for a few months. By December 2017, though, the price had hit $20,000. The third halving was in May 2020, when the cryptocurrency traded at $9000. Bitcoin was trading at nearly $20,000 a pop by December of that year.

Another reason why the price of Bitcoin may keep rising is deflation. Unlike your typical fiat currency, whose number can be endlessly increased at the behest of governments and central bankers, the supply of Bitcoins is capped at 21 million. The total number of spendable bitcoins will be lower than the theoretical maximum due to accidental loss and wilful destruction. This combination of informal limits and a hard cap imposes severe deflationary pressure on the cryptocurrency, implying continuing price increases.

Increasing adoption could also keep nudging the price of the cryptocurrency upward. More than 400 million Bitcoin transactions have been recorded to date, with the cryptocurrency averaging over 350,000 daily transactions. The number of daily transactions actually hit a high of 400,000 in January 2021 as demand for Bitcoin surged. The rising number of transactions may indicate that investors are increasingly confident that Bitcoin will sustain higher valuations and prices.

However, there are several caveats you should keep in mind. First, just because the SF model has proven accurate for historical data does not mean it will always be on the money in the future. For instance, PlanB, the anonymous personage who first used the SF model to analyse Bitcoin prices, predicted that the cryptocurrency’s price would hit $10,000 at the close of 2019. However, its highest price in December 2019 was a hair below $7600. This means you should take SF-based prognostications with a grain of salt.

SF analyses may have another weakness: scarcity may not play as important a role in the price of Bitcoin as the model assumes. As Bloomberg Markets editor Joe Weisenthal and gold bull Peter Schiff noted in tweets and blog posts in 2019, commodities such as gold are not valuable simply due to their scarcity but also because they have real-world uses. In a series of tweets in 2019, cryptocurrency analyst Alex Krüger went even further and argued that speculative demand, not supply constraints, is what primarily determines the price of Bitcoin. These and other debates are a tacit acknowledgement that the reasons for the cryptocurrency’s price swings are not always clear.

Another caveat you should remember is that Bitcoin prices are susceptible to manipulation. For instance, a forensic study by professors John Griffin of the University of Texas and Amin Shams of the Ohio State University revealed that the Bitcoin boom of 2017, in which prices hit $20,000, was almost entirely the result of an unidentified market manipulator. Another study from Bitwise, an asset manager who is in the process of listing a Bitcoin exchange-traded fund, revealed that unregulated exchanges fake 95% of Bitcoin spot trading.

The last caveat you should keep in mind concerns Bitcoin’s volatility. While prices have stabilised somewhat over the last few years, wild price swings are not uncommon.

So, should you invest in Bitcoin? Yes… maybe. It all depends on your risk profile and investment horizon. If you are aged 85 and your investments are your primary income source, investing in Bitcoin may not be a good idea because of its volatility. If you are young, a buy-and-hold strategy—”holding,’ in the argot of cryptocurrency investors—may be a good option because it allows you to ride out the volatility.

You should not invest more than you can afford to lose; bitcoin remains a highly speculative investment. Thoroughly research before you invest, conduct your purchases through regulated exchanges to avoid scams, and steer clear of deals that seem too good; they probably are. Store your holdings in hardware or offline wallets to keep them safe from hackers, and do not forget your wallet password! Consult others, and learn from your mistakes.